Planned Giving

Planned Giving for Financial Advisors

Business Interests, Closely-Held Stock, Partnerships

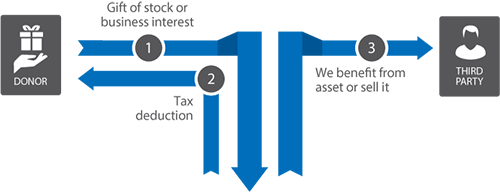

How they Work

- Your client donates shares of closely-held stock, business or partnership interests to Gaylord Hospital.

- Gaylord Hospital may hold the shares and collect dividends or distributions, or it may offer the stock back to the company or partnership for redemption or re-purchase. Gaylord Hospital will apply dividends or proceeds to the purposes your client designates.

Benefits for your client

- Your client will receive gift credit and an immediate income tax deduction for the appraised value of her shares, even if their original value was close to zero.

- Your client will pay no capital gains tax on any appreciation that has taken place in the shares.

- Under certain conditions, your client may be able to use closely-held shares to fund a life-income arrangement, such as a Charitable Gift Annuity or Charitable Remainder Unitrust (CRUT).

In This Section

Have Questions About Giving?

Our team is here to help. For more information, please call (203) 284-2881 or contact our team via the button below.