Planned Giving

Planned Giving for Financial Advisors

Charitable Remainder Trust (CRT)

One of the most flexible “life income” gift options is a Charitable Remainder Trust. Charitable Remainder Trusts are available in a variety of formats and can be funded with a wide range of assets, including low-dividend stock, cash or real estate. A Charitable Remainder Trust provides annual payments to your client and/or other beneficiaries she designates for life or for a designated term. The remainder is then put to use by Gaylord Hospital as your client directs.

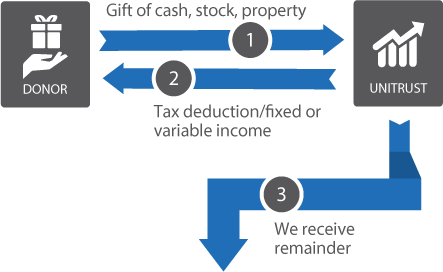

How they work

- Your client transfers cash, securities or other appreciated property into a trust.

- The trust pays your client and/or other beneficiaries regular payments. The payments will be fixed or variable depending on the trust format selected.

- When the trust terminates, the remainder passes to Gaylord Hospital to be used for the purposes your client designates when she creates her trust.

NOTE: There are varieties of Charitable Remainder Trusts that offer particular benefits to suit your client's goals and assets. Follow the links for details:

- Charitable Remainder Unitrust

- “Flip” Charitable Remainder Unitrust

- Net-Income Charitable Remainder Unitrust

- Charitable Remainder Annuity Trust

Benefits for your client

- Your client will receive an immediate income tax deduction for the charitable portion of her contribution.

- Your client will defer or avoid capital gains tax on appreciated assets contributed.

- Your client and/or her designated beneficiaries will receive income for life or a term of years.

In This Section

Have Questions About Giving?

Our team is here to help. For more information, please call (203) 284-2881 or contact our team via the button below.