Planned Giving

Planned Giving for Financial Advisors

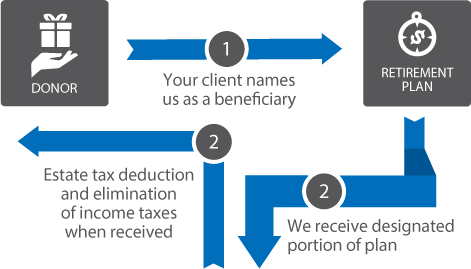

Retirement Plan — Beneficiary Designation

How they work

- Your client names Gaylord Hospital as the beneficiary of a portion or all of her IRA, 401(k) plan, or other retirement account.

- When the time comes, the amount designated passes to Gaylord Hospital income- and estate-tax free.

- Important! Tell the Hospital about your gift. Your plan administrator is not obligated to notify us. So if you don�t tell us, we may not know.

Benefits for your client

- Your client's estate can escape both estate AND income tax levied on retirement assets by leaving them to Gaylord Hospital.

- Your client can give the most heavily-taxed assets in her estate to Gaylord Hospital and leave more favorably-taxed property to her heirs.

- Your client won't affect her cash flow during her lifetime — and she can continue to take withdrawals during her lifetime.

- Your client can change her beneficiary if her circumstances change.

- Your client can create a meaningful legacy at Gaylord Hospital.

In This Section

Have Questions About Giving?

Our team is here to help. For more information, please call (203) 284-2881 or contact our team via the button below.