Planned Giving

Planned Giving for Financial Advisors

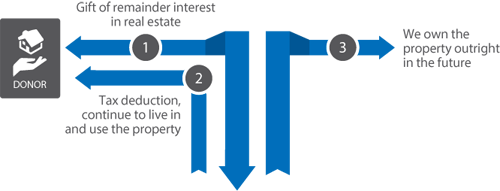

Retained Life Estate

How they work

- Your client transfers the title to her personal residence, vacation home or farm to Gaylord Hospital, allowing the client to retain the use and enjoyment of the property for life.

- Your client (or her designated beneficiary) continues to live in and use the property, and she continues to be responsible for all taxes, insurance, maintenance, and upkeep.

- When the life estate ends, the property passes to Gaylord Hospital.

Benefits for your client

- Your client donates a significant asset but retains for herself (or her beneficiary) the enjoyment of the property for life or for a term of years.

- Your client receives an immediate income tax deduction for a portion of the appraised value of her property.

- Your client (or her beneficiary) can terminate her life estate at any time during her lifetime and receive an additional income tax deduction.

- If Gaylord Hospital and the life tenant agree to sell the property at a future date, the sale proceeds will be divided between Gaylord Hospital and the life tenant.

In This Section

Have Questions About Giving?

Our team is here to help. For more information, please call (203) 284-2881 or contact our team via the button below.